Note: This is the fifth in a series of blog posts about the Fiscal Year 2022 proposed budget and tax rate.

It’s just 2 cents, but that 2 cents is a Big Deal in Round Rock.

The City collects 2 cents on every $1 spent on a taxable good or service in Round Rock. Over the years, because of strategic choices made by City leaders, sales tax revenue has been leveraged in all kinds of amazing ways to make Round Rock a great place to live.

We anticipate collecting $84.4 million in sales tax revenue in FY 22. It’s the largest source of revenue for our 133.5 million General Fund, which pays for basic services like police, fire, parks and library. Sales tax revenue also funds major road projects and helps keep Round Rock’s property tax rate among the lowest in the state for comparable cities.

Here’s a breakdown on what makes up that 2 cents: One cent goes toward basic services through the General Fund; a half-cent goes to transportation and economic development programs; and a half-cent goes to reducing the property tax rate.

Half-cent for property tax reduction

Let’s start with the last half-cent. Voters in the 1980s opted to increase the local sales tax rate by a half cent in Round Rock, and dedicate that revenue to property tax reduction.

Under the current proposed tax rate, that half-cent reduces the property tax rate by 13.0 cents. That adds up to a savings of $31 per month for the average homeowner, which is about 25 percent of their City tax bill.

Half-cent for roads, economic development

In the late 1990s, voters approved a Type B sales tax, which provides an additional half-cent for major transportation projects and economic development. That dedicated revenue stream has given Round Rock the ability to implement transportation plans designed to address the No. 1 problem cited by residents in our biennial surveys: traffic.

In the proposed budget, that half cent is expected to generate $22 million in revenue for FY 22. That helps pay for our current Driving Progress road building program, as well as our economic development partnership with the Round Rock Chamber. We’re also using this Type B sales tax to fund a new parking garage that will serve the new library and our growing Downtown business and entertainment district.

One cent for general government

The remaining penny of the sales tax rate goes toward all the basic services the City provides except for our water, wastewater, and stormwater utilities. Sales tax makes up 43 percent of General Fund revenues, compared to the 35 percent paid for by property taxes.

Sales tax revenue took on increased importance to the City when Dell Technologies moved its headquarters here more than 25 years ago. When Texas customers buy goods or services from Dell, the City collects local sales taxes. As Dell has grown, that revenue stream has grown.

Dell sales grew so quickly, the City Council prioritized diversifying sales tax revenue sources to avoid overdependence in the early 2000s and began actively seeking “destination retailers,” large stores or shopping centers that attract customers regardless of its location. Round Rock Premium Outlets and IKEA opened in 2006, followed by Bass Pro Shops in 2015.

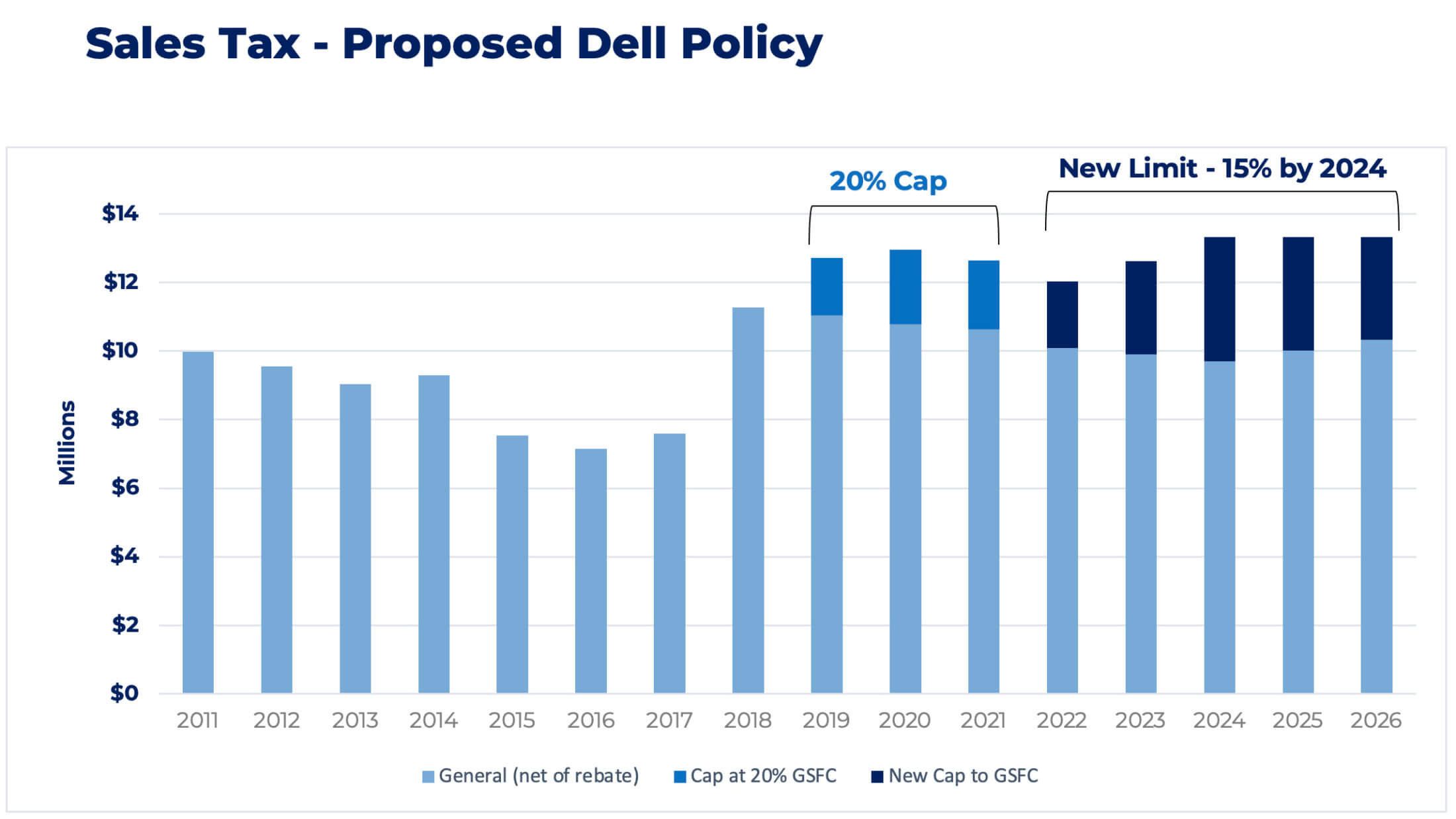

Even with that diversification, City leaders continue to take a conservative approach to spending Dell sales tax. By policy, the City has limited how much of that revenue can be used for day to day operations. With this budget, the City Council will consider further limiting General Fund reliance on Dell sales tax revenue, gradually transitioning from a 20 percent cap in FY 21 to 15 percent by FY 24.

Part of the rationale for lowering reliance on Dell revenue is to achieve a more sustainable balance between sales tax revenue and property tax revenue. Recent sales tax rules changes that are currently under litigation would have a negative impact on the Dell revenue, and it just makes good business sense to have a better balance of revenues.

Any revenue that comes in above that self-imposed limit goes into the General Self-Finance Construction (GSFC) fund to pay for one-time capital expenses.

In the proposed budget, GSFC will fund nearly $20 million for projects such as street maintenance, trails and the new library. That’s $20 million that didn’t come from property taxpayers or needs to be added to existing debt obligations, which are typically supported by property tax revenue.

Like we said up top, it’s just 2 cents. But that 2 cents goes a long way in this proposed budget as the City keeps Building Toward the Future.