Mayor Craig Morgan writes a monthly column for the Round Rock Leader.

When I wrote last year’s column on our budget for the fiscal year that started Oct 1, 2020, the City of Round Rock was proposing a budget under extremely uncertain circumstances due to COVID-19. We projected limited revenues and implemented several cost-saving measures, such as a hiring freeze, to weather the economic storm.

Even though we are still dealing with the impacts of the pandemic today, our economic future is more certain this budget season. Revenues continued to grow over the past year — and so did our population and the resulting demand for services. This year, we are looking to restore operational budgets and resuming hiring of positions across all City services. Most importantly, we are proposing a budget that renews our commitment to build toward the future.

When I say “build,” I mean that quite literally. This year’s proposed $525.4 million budget is heavy on infrastructure spending – including a record $133 million for road construction. We’ve continued our five-year Driving Progress program through the pandemic to create more connectivity and capacity in our road network, so that we’ll be prepared for the growth to come.

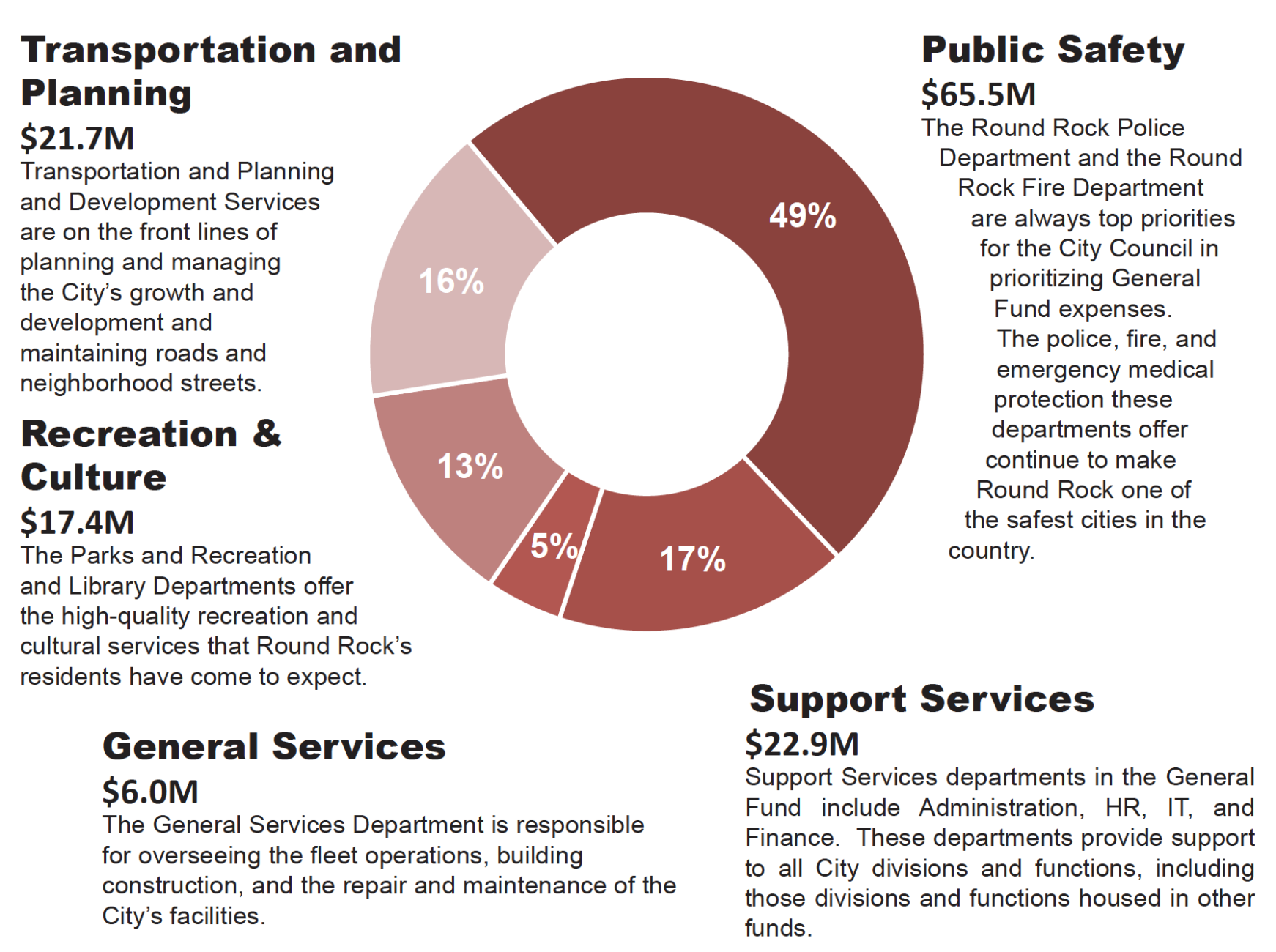

We’re also building on public safety so that Round Rock continues to be one of the country’s safest cities. The proposed budget includes significant investments in both police and fire, which together make up nearly half of the $133.5 million General Fund. This year’s Fire Department budget proposes a new, 14-member team of mental health first responders, integrating with police and emergency management to provide emergency and non-emergency behavioral healthcare.

There are several programs and services that this year’s budget supports at a great value — from extending trails and investing in our water and wastewater system to adding 10 new employees to our Police Department and six new Transportation personnel to support our growing community. That value may be even better than you realize.

The City’s property tax revenues help pay for core services including police, fire, transportation, parks and recreation and the library. But by design, the funding for our budget does not rest solely on the backs of Round Rock homeowners. Residential property taxes are projected to generate $25.5 million in revenue, which is about 19 percent of the $133.5 million General Fund. That’s not even enough to cover the annual budgets of either the Police or Fire Departments, which are budgeted at $36.9 million and $28.6 million, respectively.

FY22 General Fund Expenses

How is that possible? For each dollar we collect in residential property tax revenue, we collect $4.25 in other sources of revenue for our General Fund, which pays for these basic services. For instance, even though single-family residences make up about 92 percent of our City’s parcels of land, the 8 percent of commercial development pays approximately 45 percent — almost half — of our total property tax revenues.

Sales tax revenues cover the majority of the cost of our core services. This funding source provides 43 percent of the revenue for our general fund, and a half cent of sales tax collected for property tax reduction saves the average homeowner $31 per month on their City tax bill. Another half-cent collected for economic development and major transportation projects is expected to raise $22 million in revenue this coming year, which will pay for the aforementioned downtown improvements and new road projects. It’s amazing what “Shopping the Rock” does for our community.

Although we are able to leverage several sources of revenue to pay for the majority of City services, property tax revenues continue to be an important piece of the puzzle, providing stability in uncertain economic times so we can continue great City services year after year.

City Council is currently considering a property tax rate for our upcoming budget at 39.7 cents per $100 valuation. That means if your home is valued at $287,101 — the median taxable value in Round Rock — the City portion of your property tax will be approximately $95 per month. The proposed tax rate is an increase of 1.0 cent above the No New Revenue rate, which generates the same amount of revenue as the previous year based on the growth in property values from the previous year. This additional cent will cost $2.29 per month to the owner of a median taxable value home and allow us to continue to move forward with adding road capacity through our Driving Progress program.

As Round Rock grows, it’s true that new homes and businesses provide new revenue in the form of property taxes; however, these revenues do not come close to covering our cost increases, which are mostly in public safety. The new property added to our tax rolls this year will generate $1.5 million toward our General Fund. This might sound like a lot, but this amount is barely enough to build one quarter of a mile of one lane on the University Boulevard widening project.

The City of Round Rock stands ready to meet the demands of our growing community, thanks to smart fiscal stewardship and our long-term strategic planning efforts. As we continue to grow, this year’s proposed budget pays for the people and programs necessary to keep us Building Toward the Future. To learn more about this year’s budget and proposed tax rate, visit roundrocktexas.gov/budget.