Note: This is the fourth in series of blog posts about the Fiscal Year 2022 budget and tax rate proposal.

It’s property tax rate setting season, and you likely have been reading about how most taxing entities in Central Texas are lowering their tax rates.

That’s true for the City of Round Rock, as well. The proposed tax rate of 39.7 cents is 4.2 cents less than the current rate. That’s because property values have risen significantly, and there’s an inverse relationship between values and tax rates – as values rise, the base tax rate goes down.

What we’ll also emphasize (note the headline above) is the tax payment for the average residential property taxpayer is going up. In Round Rock, it’s going up about $2 per month. The increase is needed to begin paying for the $30 million in debt approved by City Council earlier this year for the latest installment on the 5-year, $240-million Driving Progress road improvement program.

We’ll have more on the road program below. First, we think there are other parts of the property tax story you’ll find interesting.

There has been a lot of commercial and residential development over the past year. In fact, $381 million in value has been added to the City’s property tax base, which now stands at $17.7 billion. At the proposed tax rate, the new value will produce $1.5 million in new revenue. Not an insignificant sum, to be sure, but that would build about a quarter mile of one lane on the current University Boulevard widening project.

As noted in our first budget blog post, the City Council is considering a $525 million budget that meets the growing demands of our growing community with the high-value services Round Rock citizens expect, most notably for additional public safety staff. While there are significant investments planned for infrastructure, there are no increases proposed for water, wastewater and stormwater utility rates.

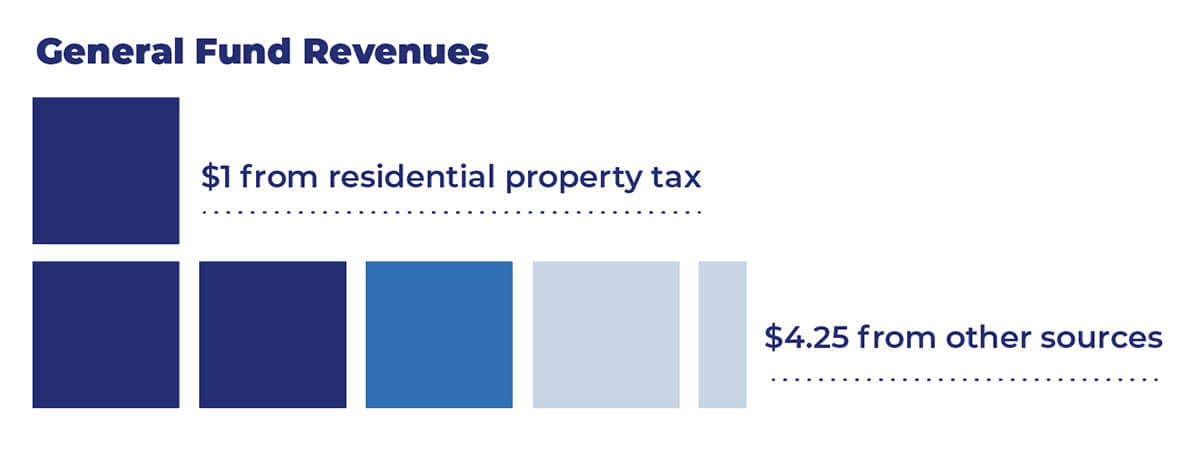

Our City Council understands no homeowner likes paying more in property taxes, which is why we work hard to diversify our revenue sources. How hard? For each dollar we collect in residential property tax revenue, we collect $4.25 in other sources of revenue for our General Fund, which pays for basic services like public safety, parks and the library.

Here’s another way to look at it: Residential property taxes are projected to generate $25.5 million in General Fund revenue, which is about 19 percent of the General Fund. That’s not enough to cover the annual budgets of either the Police or Fire department.

Commercial properties, which comprise just 8 percent of the total number of parcels, generate 45 percent of property tax revenue. That’s a primary reason why economic development is a City Council priority.

Sales tax impact

Sales taxes are a major mitigator of property tax rates in Round Rock. Sales taxes make up 43 percent of the projected $133 million in total General Fund revenues, while property taxes are 35 percent.

We expect sales tax revenues to continue to grow in FY 22, thanks to a strong local economy and continued population growth. That’s great news for all property taxpayers, because of the 2 cents we collect for each dollar of taxable local sales, there’s a half-cent that goes directly to property tax reduction.

We project this half-cent will save 13 cents on the property tax rate for FY 22. That will save the median homeowner $31 a month, or 25 percent, on their monthly tax bill.

Driving Progress

Back to the road program. The $30 million in certificates of obligation issued this spring was the third of an anticipated five bond issues totaling $140 million to help fund the Driving Progress program.

Among the potential projects in this round of funding are improvements to: Deepwood Drive, Gattis School Road, Kenney Fort Boulevard, Logan Street, McNeil Road, North Mays Street, Oakmont Drive, Old Settlers Boulevard, Red Bud Lane, RM 620, SH 45 Frontage Road, University Boulevard, Wyoming Springs Drive, County Road 112 and the South Mays Corridor.

Like our diversified approach to revenues for the General Fund, there are sources other than property taxes that pay for road improvements, like Roadway Impact Fees that are paid by developers to cover some of the costs of expanding our transportation network necessitated by their projects. We also aggressively apply for federal grants and partner with Williamson County to share costs on regional projects.

Sales tax revenues fund a significant number of major transportation projects as well. We’ll have more on that in a post next week.

One piece of the property tax pie

As mentioned above, the City isn’t the only entity that taxes your property. For homeowners in Round Rock, City property taxes are about 19 percent of your total bill. The balance goes to the Round Rock ISD (54 percent), Williamson County (19 percent), Austin Community College (5 percent), Williamson County Road District (2 percent), and the Upper Brushy Creek Water Control and Improvement District (1 percent).

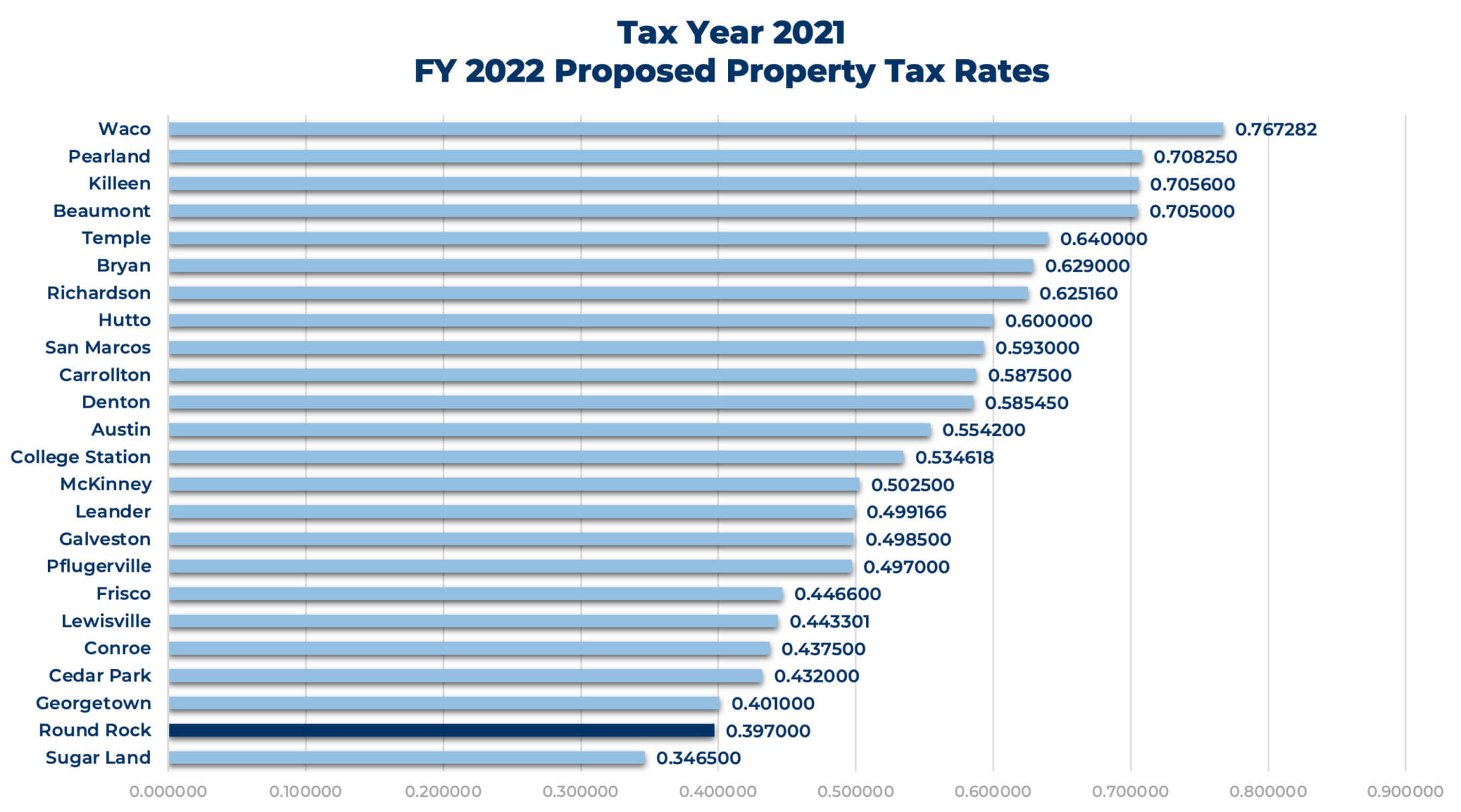

We think it’s worth noting how we stack up against our peers across the state. As the chart below shows, our tax rate is among the lowest in the state for comparable cities. As evidenced by our recent recognition for “Leading the Way” in the delivery of outstanding services, we believe the City of Round Rock offers outstanding value for the tax dollars you pay. That’s how we’re Building Toward the Future with the FY 22 budget.