Debt Obligations

The City of Round Rock is committed to Transparency. Transparency provides our citizens with information and promotes accountability.

The City’s current outstanding debt is comprised of general obligation (GO) bonds, certificates of obligation (CO) debt, limited tax notes, utility revenue bonds, sales tax revenue bonds, venue tax and hotel occupancy tax revenue bonds, and other notes payable.

General Obligation Bonds: are debt instruments issued by State and local governments as a source of funds for the acquisition and construction of major capital equipment, infrastructure, and facilities. They are backed by the full faith and credit of the issuer, including the power to tax its citizens. GO bonds must be approved by the voters and the City is required to compute at the time other taxes are levied, the rate of tax required to provide a fund to pay interest and principal at maturity.

In April 2022, Standard & Poor’s affirmed the City’s AAA rating for its Obligation bonds; this is the highest credit rating possible.

Certificates of Obligations: are generally short-term in nature. They are backed by taxes, fee revenues, or a combination of the two and do not require a vote by the citizens.

Limited Tax Notes: were issued to purchase City vehicles. They are generally short-term in nature and will be repaid from ad valorem taxes. They do not require a vote by the citizens.

Utility Revenue Bonds: are issued to fund capital projects for the water, sewer, and drainage systems and related facilities. They are repaid with utility revenues.

The City’s utility revenue bonds are rated AAA by Standard & Poor’s.

Venue Tax & Hotel Occupancy Tax Revenue Bonds: were issued to fund a portion of the construction of the Sports Center. Hotel Occupancy Tax (HOT) Revenue Bonds were issued to fund the City’s portion of the construction of the convention center complex at Dell Diamond. Both of these revenue bonds are to be repaid from the hotel tax revenues.

The City’s Hotel revenue bonds are rated A+ by Standard & Poor’s.

Sales Tax Revenue bonds: have been issued to fund transportation improvements. The bonds are to be repaid from revenues of the Round Rock Transportation and Economic Development Corporation. Sales tax revenue bonds were also issued to design and construct a convention center adjacent to the Kalahari Resort Hotel. These particular bonds will be repaid from HOT revenues associated with the Kalahari Resort.

In April 2021, the City’s sales tax revenue bonds long-term rating was AA- by Standard & Poor’s.

State Infrastructure Loan: from the Texas Department of Transportation was received to fund a specific transportation project including utility relocation, right-of-way acquisition and construction. The loan will be repaid from sales tax revenues of the Round Rock Transportation and Economic Development Corporation.

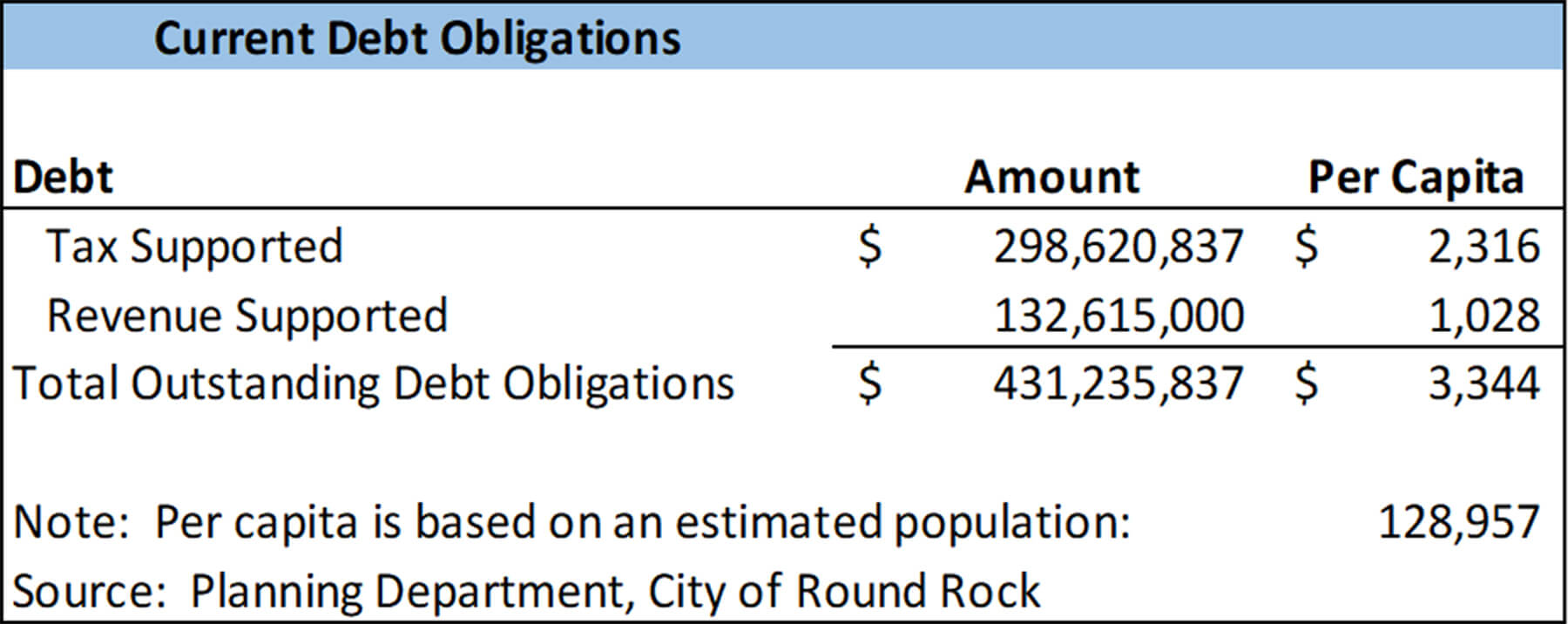

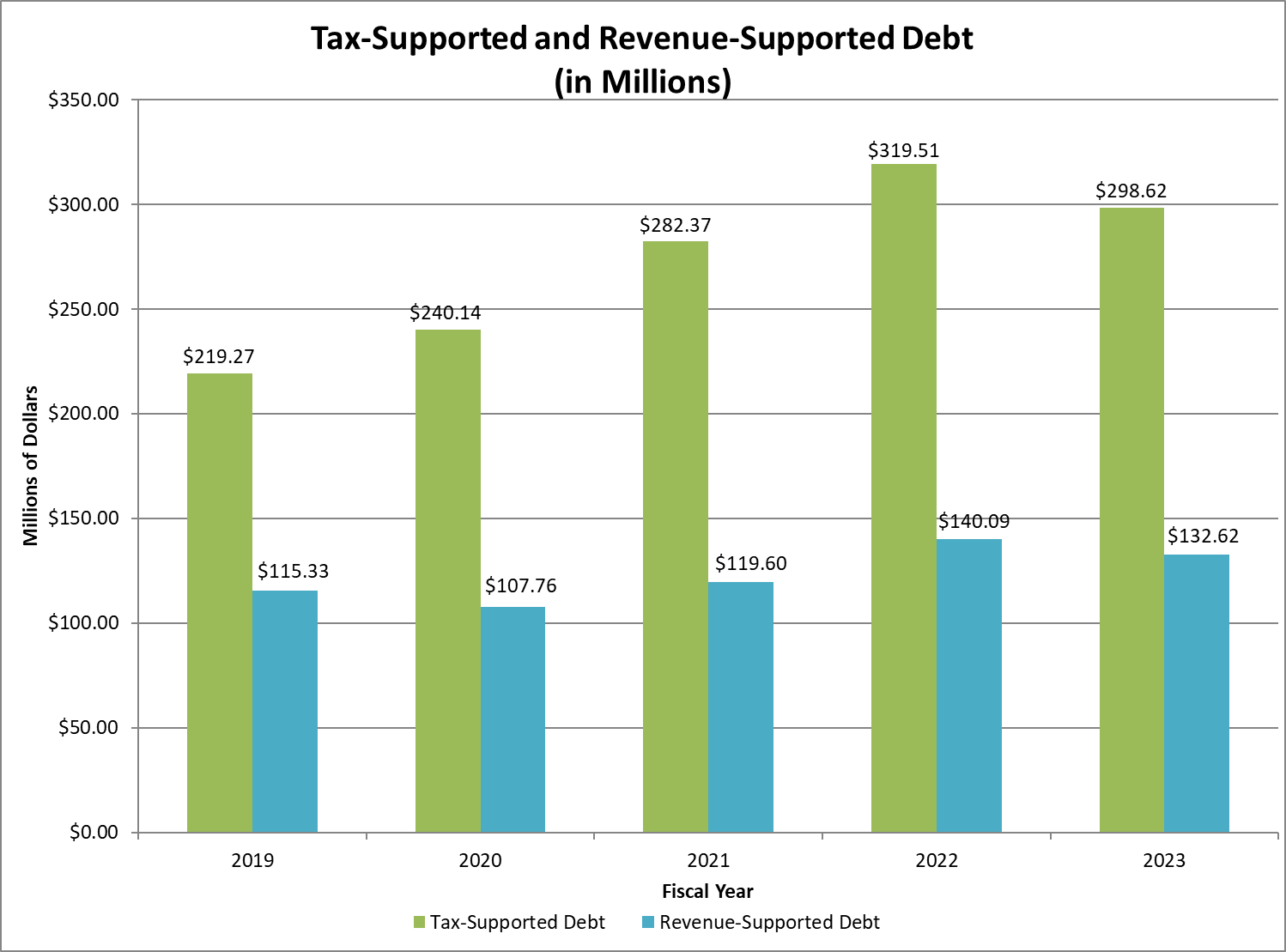

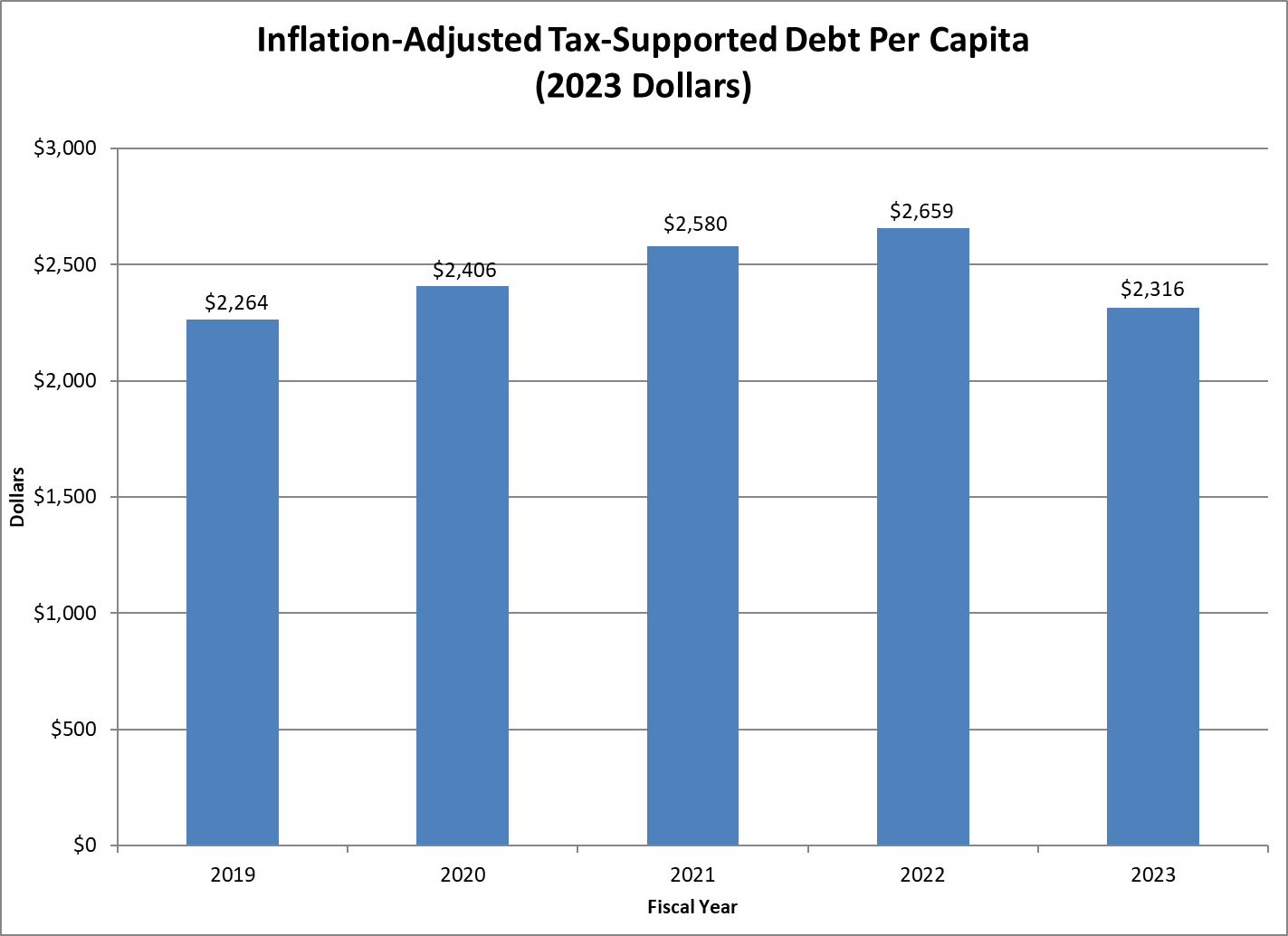

At the end of the fiscal year 2023, the City of Round Rock had total debt outstanding of $431,235,837. Of this amount, $298,620,837 comprises debt backed by the full faith and credit of the City. The remainder of the debt is secured solely by specified revenue sources (i.e. revenue bonds).

HB 1378: Debt Obligation Reporting

The 84th Legislature passed HB 1378 to increase the transparency of local government debt. Under Local Government Code § 140.008, political subdivisions, including counties, cities, school districts, junior college districts, special purpose districts, and other subdivisions of state government must annually compile their debt obligation data from the preceding fiscal year.

Current Debt Obligations as of 9/30/23: Outstanding direct debt obligations, tax and revenue supported, as well as State Infrastructure Bank (SIB) loans and leases. Includes purpose, credit rating, outstanding principal amount, debt service, and spent and unspent proceeds issue-by-issue.

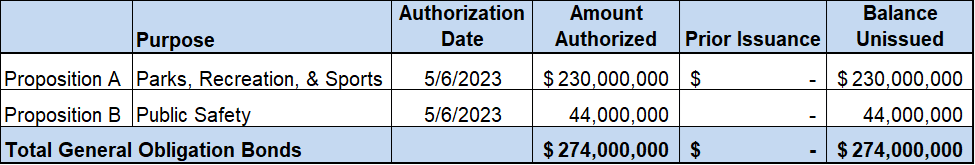

Bond Authorization Balance Information as of 9/30/23: Authorized debt, issued and unissued amounts.

These reports are available for public inspection. Please contact Liana Ellison at lellison@roundrocktexas.gov or 512-341-3158.

Historic Bond Election Information as of September 2023

The City of Round Rock has a bond election to be held May 6, 2023. Proposed are two General Obligation (GO) bonds totaling $274 million for long-term capital projects. Proposition A covers parks, recreation and sports facilities and amenities for a total of $230 million. Proposition B will fund public safety facility improvements totaling $44 million.