The Round Rock City Council will vote Thursday, Sep. 26, on a slight increase in property taxes this coming year. While no one likes paying more in taxes, the increase is needed to ensure the City has the budget necessary to deliver the high-value services our citizens expect and build the infrastructure necessary to keep up with a growing population.

While it’s easy to target property taxes as evidence of government spending run amok, consider this: For every $1 of residential property tax, the City uses another $4.36 from other sources to fund the $121 million General Fund budget, which pays for core services like Police, Fire, Library, Transportation, and Parks. Let that sink in a minute.

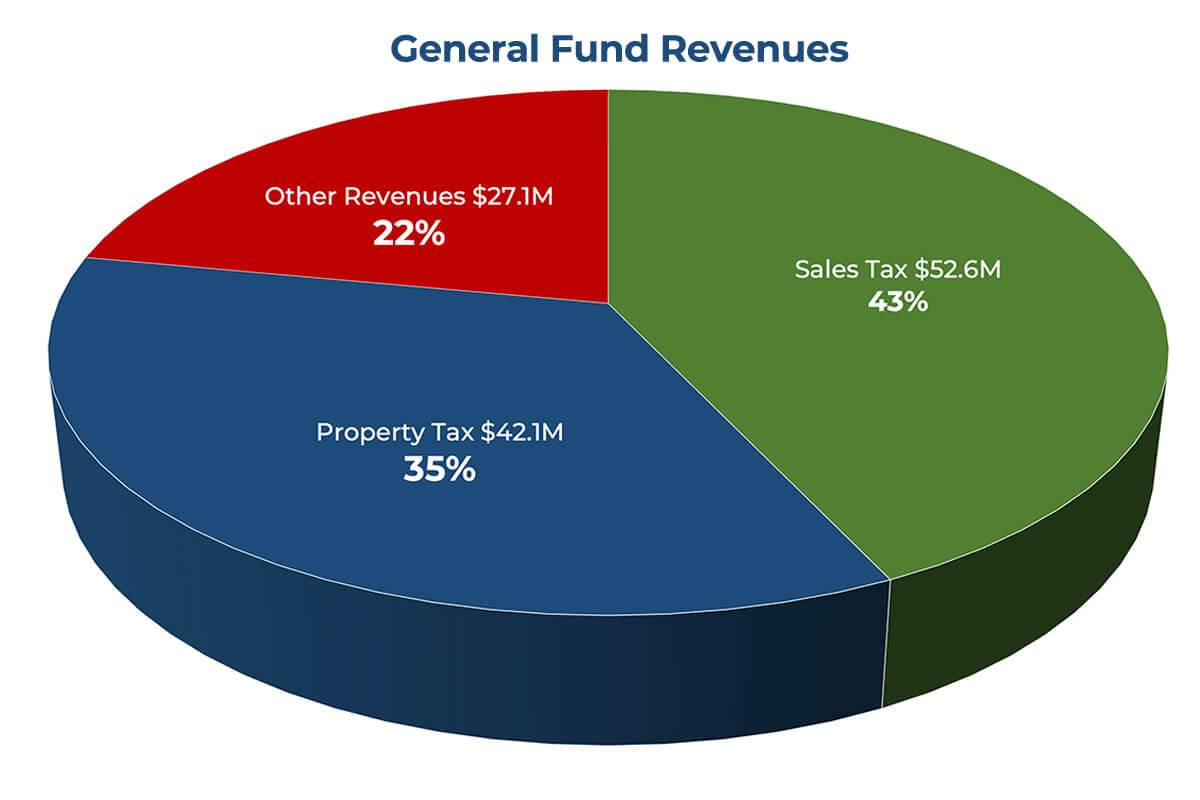

Property taxes comprise just 35 percent of our General Fund. So where does the rest of the money for the General Fund come from? Sales taxes make up the largest source of revenue at 43 percent, with other fees and service charges covering the remaining 22 percent.

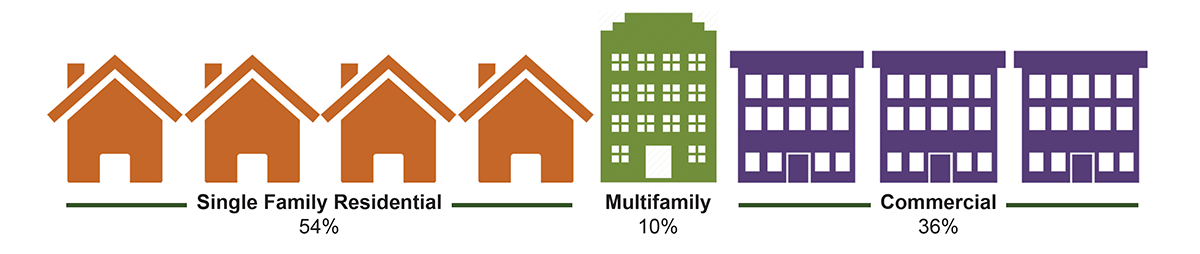

Back to property taxes. Consider this: Even though single-family homes make up 92 percent of the properties in Round Rock, nearly half of all property tax revenues are paid by owners of non-single family property.

Single-family homes will contribute $23 million — about 19 percent — of General Fund revenues forecast for fiscal 2020.

What’s really interesting is that commercial properties (which includes multifamily) makeup just 8 percent of the real estate parcels, but are responsible for 46 percent of the $14.7 billion of the taxable value in Round Rock. That’s why the City works so hard with our partners at the Round Rock Chamber to attract businesses like Kalahari Resorts and Conventions and UPS to locate here. They’re capital-intensive businesses that contribute significantly to our property tax base.

Think about it this way: If all the City had was property tax revenue to fund general government, we could only afford Police and the Library, with $5 million dollars left over for everything else – Fire, Parks and Recreation, Transportation, General Services and support services like Finance and Information Technology.

To drill down even further: If all the City had was single-family property tax revenue, we couldn’t cover the Fire Department’s $24 million budget.

Property tax proposal

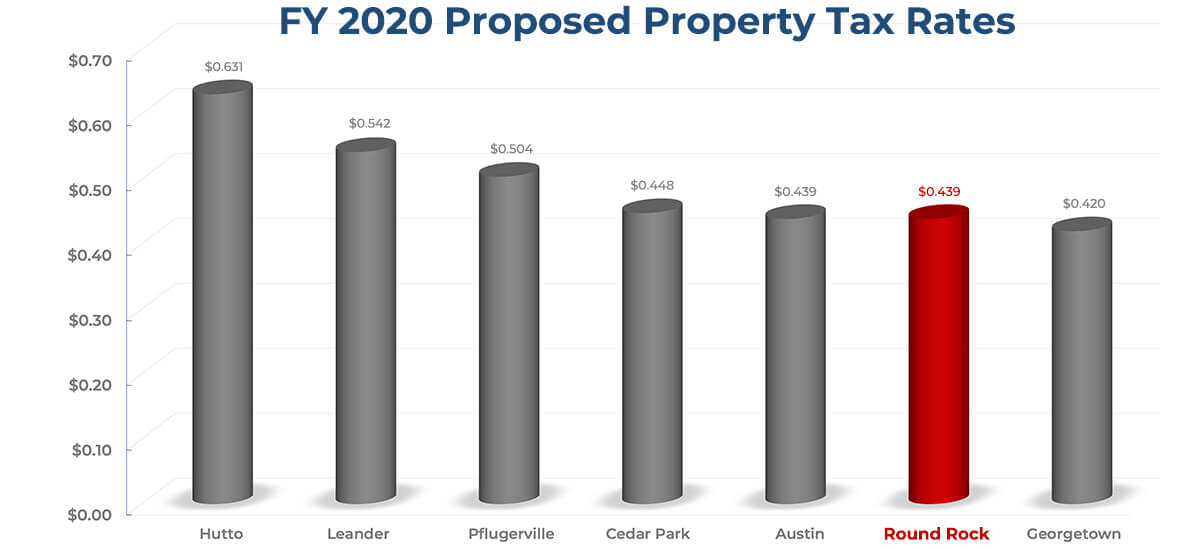

Let’s look at the proposed property tax rate. The City Council is considering a property tax rate of 43.9 cents per $100 of valuation, an increase of 3.7 cents above this year’s effective tax rate of 40.2 cents. The effective tax rate takes into account the 5 percent growth in existing property values from last year. The increase allows the City to fund one-time public safety equipment replacements (.5 cent), debt payments for a five-year road improvement program (1.5 cents) and to keep up with rising operating costs of public safety and city services, including 10 new employees, six of whom are needed for public safety (1.7 cents).

At the proposed rate, the owner of a median value home worth $255,198 will pay $93 per month in City property taxes next year. That’s an additional $8.84 per month compared to this year. You can use our handy calculator to determine what your property tax will be based on the value of your home.

Still, City property taxes could be a lot higher.

If voters hadn’t approved increasing the local sales rate back in the 1980s, your City property tax bill would be 25 percent higher. A half-cent of the 2 cents in local sales tax that shoppers pay in Round Rock goes directly to property tax reduction. That half-cent is equal to 15 cents on the property tax rate. That saves the median value homeowner $372 a year on their City tax bill. (That’s a really great reason to Shop the Rock.)

Bringing in more sales tax revenue is a primary goal of our Sports Capital of Texas tourism program. Visitors who come to play here also shop and dine here, which helps pay for basic City services and takes upward pressure off the property tax rate.

Strong sales tax revenue and a successful tourism program are big reasons why Round Rock’s property tax rate compares favorably in Central Texas and beyond.

Your total property tax bill

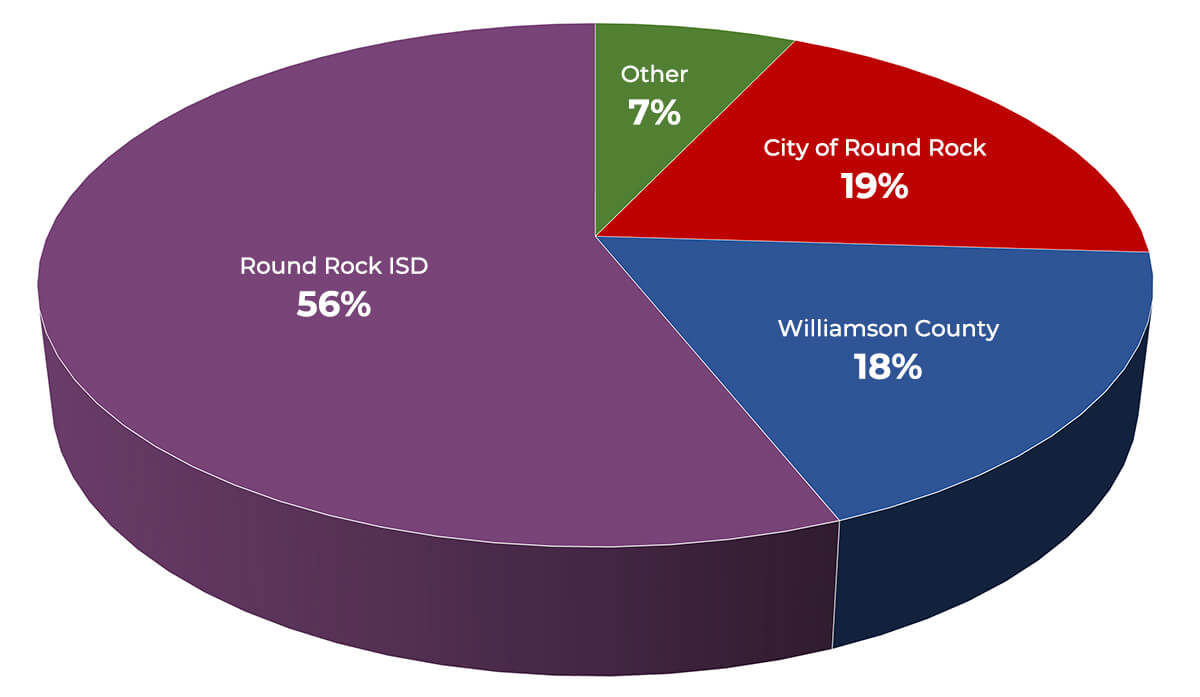

Of course, the City is only one entity which you pay property taxes to. Other taxing entities are Round Rock ISD, Williamson County, Austin Community College and the Brushy Creek Water Control and Improvement District.

The City takes up about 19 percent of your total tax bill. RRISD accounts for 56 percent, Williamson County is 18 percent, and ACC and the WCID make up the final 7 percent. So out of a total tax bill of $5,900 for the median value home, you’re paying about $1,100 toward City services. Again, we think we offer amazing value for your property tax dollars here at the City.

By no means are we saying quit complaining about property taxes. We’re just offering some perspective on how we leverage property taxes to fund City government in Round Rock. Providing remarkable value to our property taxpayers has been a foundational element in Round Rock’s future focus for many years, and this year’s budget and tax rate are no exception.