Economic Development

The City of Round Rock is committed to transparency. The goal of the City of Round Rock is to be an open government in all areas. The City is increasing its efforts in transparency as it relates to economic development programs and incentives supported by our tax dollars that are designed to attract industry and investment, create jobs and otherwise grow the economy.

For more information on the Texas Comptroller’s efforts to encourage transparency among local governments, please visit their website at https://comptroller.texas.gov/transparency/.

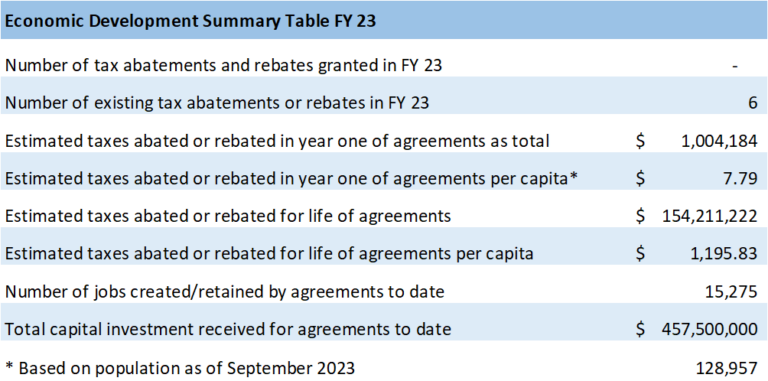

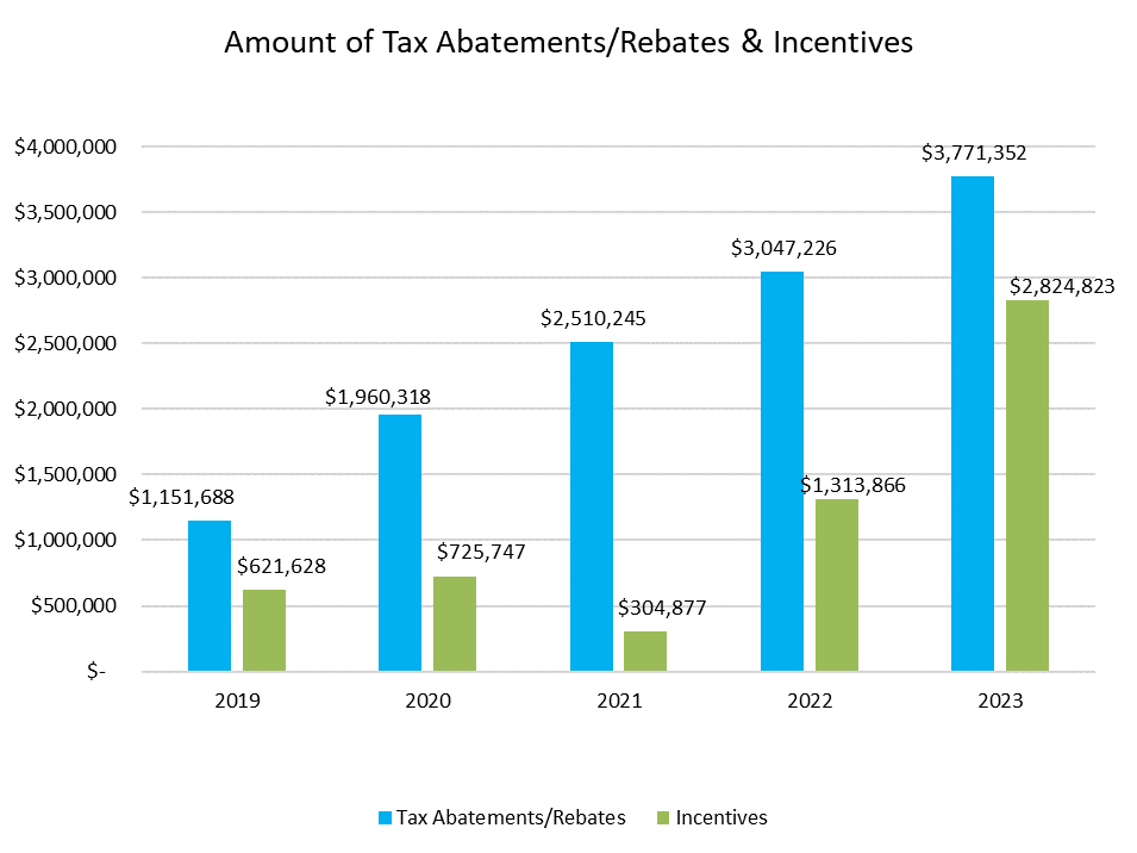

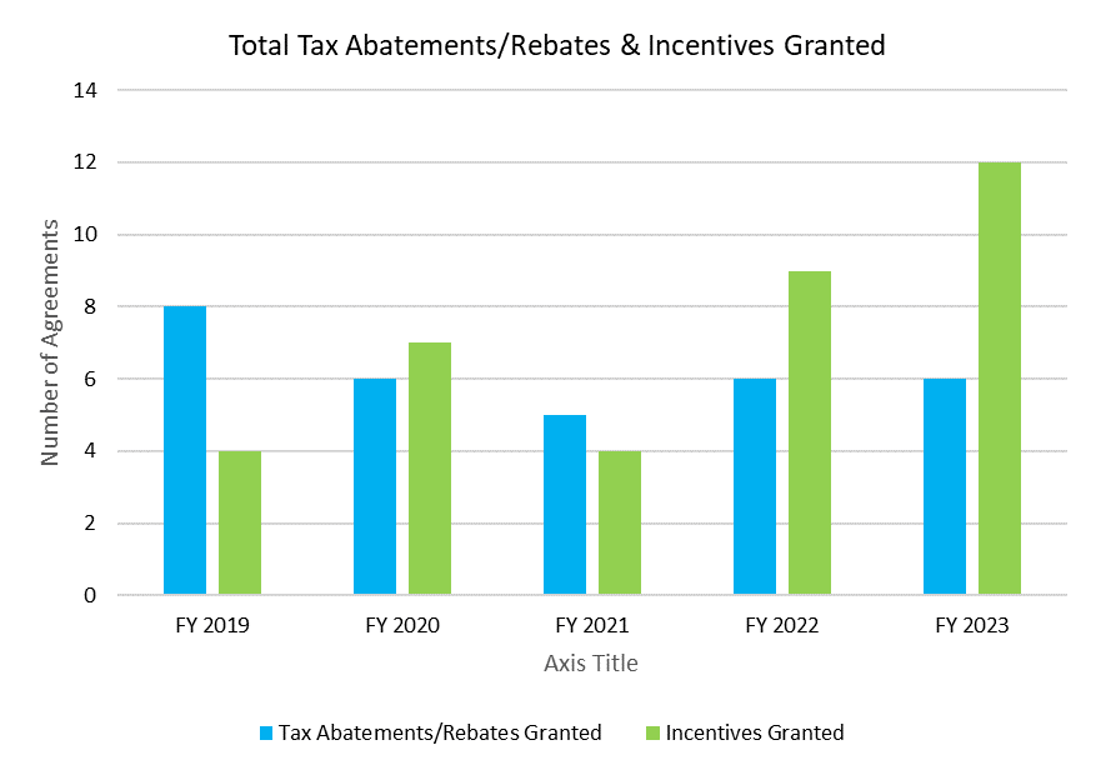

The City of Round Rock enters into economic development agreements to promote development and redevelopment within the City, generate additional sales tax revenues, enhance our property tax base and improve the quality of life for our citizens. These programs abate or rebate property taxes, hotel occupancy tax, and sales tax, include economic incentive payments, and/or reductions in fees that are not tied to taxes. The City’s economic development agreements are authorized under Chapter 380 of the Texas Local Government Code.

The City negotiates property tax abatement agreements and property tax, sales tax, and HOT tax rebates on an individual basis. Tax abatements are limited to ten (10) years in length. The City has an abatement recapture clause in all tax abatement agreements in the event that the recipient does not fulfill the requirements of the agreement. The tax rebate program is for a period of greater than 10 years, and taxes paid to the City are reimbursed back to the owner. As of FY 2023, there are no active tax abatement agreements with the City.

City of Round Rock’s Current Economic Development Agreements

- Searchable Database of Agreements FY21

- Searchable Database of Agreements FY22

- Searchable Database of Agreements FY23

- Economic Development Summary Report FY21

- Economic Development Summary Report FY22

- Economic Development Summary Report FY23

- Annual Compliance Review FY21

- Annual Compliance Review FY22

- Annual Compliance Review FY23

- Bass Pro Outdoor World, LLC

- BGE, Inc.

- Cargill Meat Solutions Corp. (Formerly Proportion Foods, LLC)

- Chatsworth Products

- ClearCorrect Operating, LLC

- Dell Computer Corporation

- EastGroup Properties, L.P. Phase I

- EastGroup Properties, L.P. Phase II

- EastGroup Properties, L.P.

- Fisher-Rosemount Systems, Inc.

- HLI Solutions, Inc

- KR Acquisitions, LLC

- Phlur, Inc.

- RRTX Lake Creek Hotel, LP

- Stonemill Hospitality LLC

- SWITCH, Ltd.

- United Parcel Service, Inc.