The City of Round Rock is regularly recognized for its outstanding work, including fiscal stewardship. The City’s annual budget makes it all possible by drawing from our City Council‘s strategic planning and our strong track record of fiscal responsibility.

Strategic Plan Goals

The City’s Strategic Plan, updated annually by the City Council at its annual retreat in February, is implemented through the budget process and shapes the City’s priorities. Explore the six strategic goals below by hovering over the icons:

About the Adopted FY 2024 Budget

Fiscal Year 2024 will take place Oct. 1, 2023 through Sept. 30, 2024. The adopted $543.9 million budget, which is supported by a tax rate of $0.342 per $100 of valuation, focused on infrastructure spending and new programs designed to meet the demands of a growing community.

| Total Adopted Budget for FY 2024 | $543.9 million |

| General Fund | $161.6 million |

| Total Community Investment Program (CIP) | $236.5 million |

| All Other* | $146.3 million |

*Includes Water and Wastewater Utility, Hotel Occupancy Tax, Stormwater, Type B (transportation and economic development sales tax), and other special revenue funds.

Property Tax Rate

On Sep. 14, City Council adopted a tax rate of 34.2 cents per $100 of valuation for Fiscal Year 2024. At this rate, the owner of a median taxable value home of $363,396 on average would pay $104 per month in City taxes, which is an increase of $8 per month over the current rate.

This adopted tax rate is the same as last year’s, and it’s the lowest adopted among cities in our area; however, the Fiscal Year 2024 adopted rate is higher than the “no new revenue” rate of 31.6 cents, which would raise the same amount of revenue as last year on existing property based on this year’s property valuations. The additional 2.6 cents is needed to pay for additional public safety positions with competitive salaries, as well as additional staffing for parks, library and other departments.

More information about local entities’ property tax rates, including how much you would owe each taxing entity under their adopted tax rates, can be found at williamsonpropertytaxes.org for Williamson County residents and travistaxes.com for Travis County residents. Below is also a link to a City of Round Rock tax calculator that allows you to type in your taxable value and see how much of your taxes will go to each City service.

Timeline for Adopted FY 2024 Budget, Tax Rate

The following timeline includes the discussion and action that will take place for the FY 2024 budget, which will fund city services, programs and projects for the fiscal year from Oct. 1, 2023 through Sept. 30, 2024:

- JULY 25, 2023 — Williamson Central Appraisal District and Travis Central Appraisal District certify tax rolls

- JULY 25, 2023 — City Council holds packet briefing and budget work session on taxable values

- JULY 27, 2023 — City Council holds annual budget workshop and vote to approve FY 2024 operating budget for the Round Rock Transportation and Economic Development Corporation (Type B)

- AUG. 8, 2023 — City Council holds packet briefing and budget work session on the proposed budget and tax rate

- AUG. 10, 2023 — Council holds vote to publish and propose maximum tax rate, set public hearing dates

- AUG. 22, 2023 — City Council packet briefing and work session on financial policies, the proposed budget and tax rate

- AUG. 24, 2023 — City Council holds budget and tax rate public hearings, first reading of tax rate and budget ordinances, and reviews and adopts financial policies

- SEPT. 12, 2023 — City Council packet briefing and work session on the proposed budget and tax rate

- SEPT. 14, 2023 — City Council holds vote on final adoption of tax rate and budget ordinances, as well as ratifying the property tax rate and an authorized purchases list

Related Articles

City of Round Rock’s AAA bond rating reaffirmed by S&P Global

City’s “very strong” management, budgetary flexibility and economy cited in report

Annual update: Round Rock’s thriving economic development program powers local jobs, low property taxes

Net tax benefit from City agreements totals $550 million since mid-1990s

City earns national award for excellence in financial reporting

Annual comprehensive financial report recognized

About the Current Year's (FY 2024) Budget

Fiscal Year 2024 will take place Oct. 1, 2023 through Sept. 30, 2024. The $543.9 million budget, which is supported by a tax rate of $0.342 per $100 of valuation, focused on infrastructure spending and new programs designed to meet the demands of a growing community. The budget included a record amount for road construction and additional public safety staff to deal with increasing challenges faced by residents.

Check out our series of blog posts about key aspects of the FY 2022 budget and tax rate. We’ll be updating this soon with more blogs about the FY 2023 budget process and proposed tax rate:

Fiscal Year 2023 takes place Oct. 1, 2022 through Sept. 30, 2023. The Round Rock City Council approved Thursday, Sept. 8, 2022, a $555.5 million budget and tax rate of $0.342 per $100 of valuation for Fiscal Year 2023. The Fiscal Year 2023 budget focused on infrastructure spending and new programs designed to meet the demands of a growing community. The budget included a record amount for road construction and additional public safety staff to deal with increasing challenges faced by residents.

The Honor-System Board Games At RRPL

ESL Practice Conversations – Patrons Try English

A Local Legend Inspires More Book Suggestions!

Learn Local with the Central Texas Learning Festival

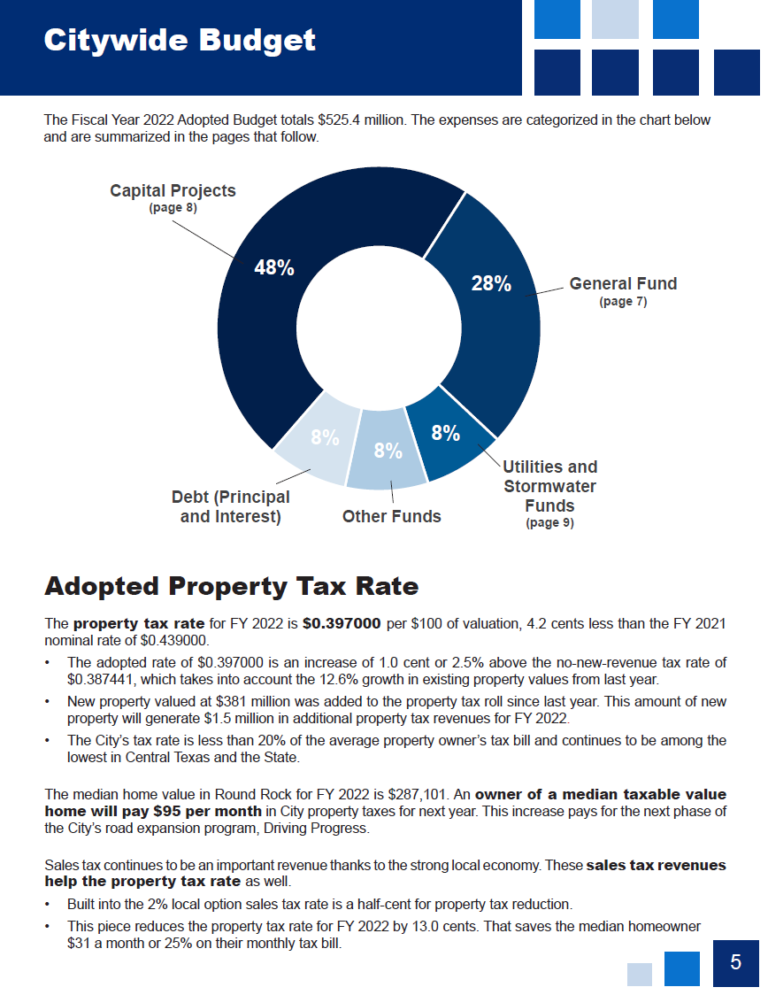

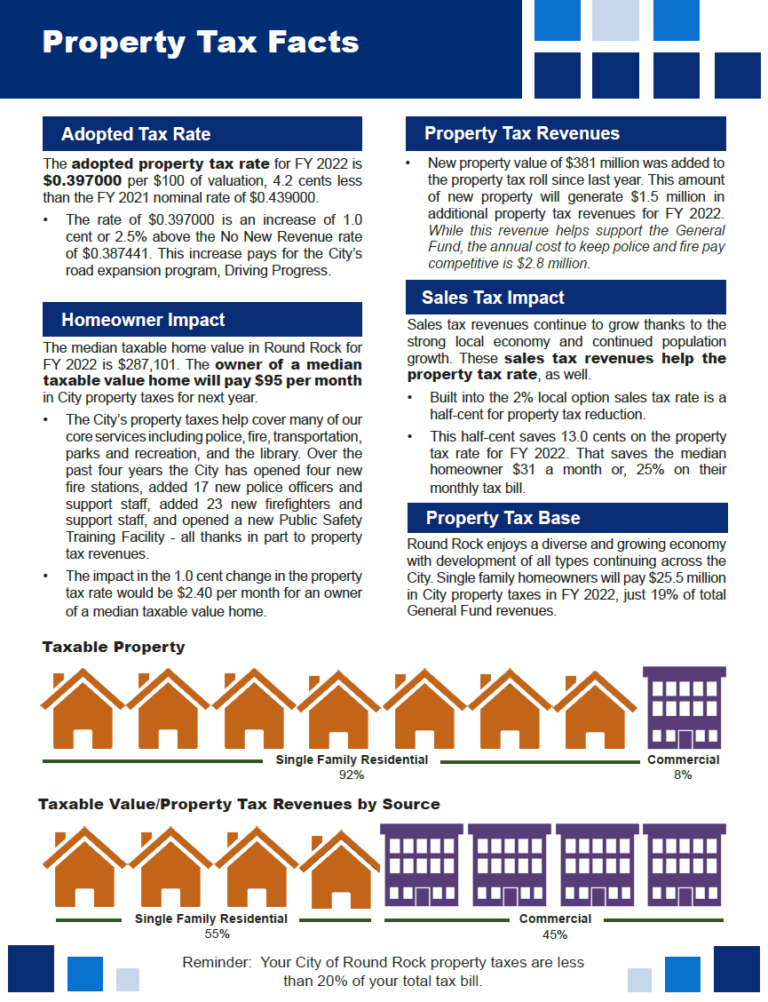

The property tax rate for the Fiscal Year starting Oct. 1, 2021, is $0.397 per $100 of valuation, 4.2 cents less than the FY 2021 City property tax rate of $0.439. However, the rate is an increase of 1.0 cent, or 2.5% above the No New Revenue rate of $0.387441, which is the rate that generates the same amount of revenue as the previous year based on the growth in property values from the previous year.

The increased tax rate provided additional funding to pay for the City’s road expansion program, Driving Progress.

The owner of a median taxable value home will see a property tax increase of approximately $2 per month. To calculate the impact to your tax bill, visit the truth-in-taxation site for your county below. These sites will calculate your tax rates for all taxing entities, and the City’s tax rate will be labeled “City of Round Rock.” All other taxing units pass their own tax rates.